Monday, June 23, 2008

The Right Choice - INDRAPRASTHA GAS (IGL)

Do you like this story?

A very low beta, high dividend yield and stability in its growth outlook make Indraprastha Gas an ideal investment choice in these uncertain times INDRAPRASTHA GAS (IGL) is a Delhi-based city gas distributor promoted by GAIL, Bharat Petroleum (BPCL) and the government of Delhi together holding 50% stake. The company distributes compressed natural gas (CNG) and piped natural gas (PNG) in Delhi and nearby region. With high inflation and slowing global economic growth, the company is expected to grow steadily over the next few years, thanks to its mature business model, strong cash flows, healthy returns on capital and assured supply of natural gas.

INDRAPRASTHA GAS (IGL) is a Delhi-based city gas distributor promoted by GAIL, Bharat Petroleum (BPCL) and the government of Delhi together holding 50% stake. The company distributes compressed natural gas (CNG) and piped natural gas (PNG) in Delhi and nearby region. With high inflation and slowing global economic growth, the company is expected to grow steadily over the next few years, thanks to its mature business model, strong cash flows, healthy returns on capital and assured supply of natural gas.

BUSINESS:

Under the administered pricing mechanism, IGL gets a total allocation of 2 million metric standard cubic meters a day (mmscmd) of natural gas from GAIL, which is nearly 25% more than the company’s current gas sales.

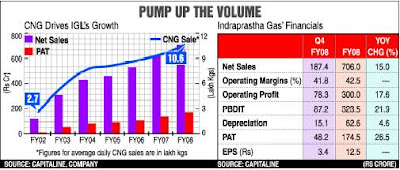

The company derives over 90% of its revenue through the sale of CNG for automobiles, while the rest comes from PNG. During FY08, CNG sales volume increased by 12.3% to 3,862 lakh kg and PNG sales volumes increased by 17.2% to 43 million standard cubic meters (mscm) over FY07. On an overall basis the sales volumes grew 12.6% to 549 mscm during FY08.

With a number of new commercial and retail customers shifting to piped natural gas, the company has witnessed a strong cumulative annual growth of 39% over the past six years in this segment. In comparison, the sales in the CNG segment have grown at a slower rate of 25%.

GROWTH FACTORS:

After witnessing fast growth in initial years after its incorporation, the company is expected to see a steady growth in the years to come. CNG and PNG being highly cost efficient options to petrol and LPG, consumer acceptance for these

alternative fuels is growing fast. Also, expansion in adjoining regions will provide the company access to other lucrative markets. For this, the company will invest around Rs 250 crore annually over the next couple of years.

Commissioning of the Petroleum and Natural Gas Regulatory Board (PNGRB) earlier this year and its recommendations afterwards had created doubts about IGL’s future profitability. However, the marketing margins charged by the company remain out of regulatory control and hence the company is not required to change its tariff rates. This ensures the sustenance of IGL’s profit growth in future.

FINANCIALS:

IGL came out with a marginally improved performance for the

quarter ended March ’08. It earned a net profit of Rs 48.2 crore on net sales of Rs 187.4 crore. Sales were 14% higher yearon-year (y-o-y), while the net profit was up 20%. For the whole year, the company posted 26.5% growth in net profit to Rs 174.5 crore while its sales grew 15% to Rs 706 crore.

IGL has reported consistent growth in operating profit margin over the past few years. It closed FY08 with an operating margin of 42.5% against 41.2% in the previous year. However, the last quarter of FY08 witnessed a slight erosion in margin to 41.8% from 43.3% in the corresponding period in the previous year.

The company holds a healthy track record of dividends. The rate of dividend has increased consistently over last six years to reach 40% in FY 2008. At the current market price of Rs 118, this translates in a dividend yield of 3.4%.

VALUATIONS:

The price-toearnings (P/E) multiple of Indraprastha Gas at the current market price of Rs 118.7 works out to 9.5. Its peer Gujarat Gas is trading at a P/E of 9.9. The current high inflation is expected to favour the company, which offers low-cost alternatives to highcost petroleum products. Considering the growing number of CNG vehicles in the Delhi region and the fact that high prices of LPG are forcing retail consumers to shift to PNG, we expect the company to grow at 20% per annum over the next two years. A very low beta, high dividend yield and stability in its growth outlook make it an ideal investment choice in these uncertain times.

This post was written by: Franklin Manuel

Franklin Manuel is a professional blogger, web designer and front end web developer. Follow him on Twitter

0 Responses to “The Right Choice - INDRAPRASTHA GAS (IGL)”

Post a Comment